State Bank Clarifies Mandate on 2-Hour Cooling Period for Digital Transactions

Understanding the 2-Hour Cooling Period in Digital Finance

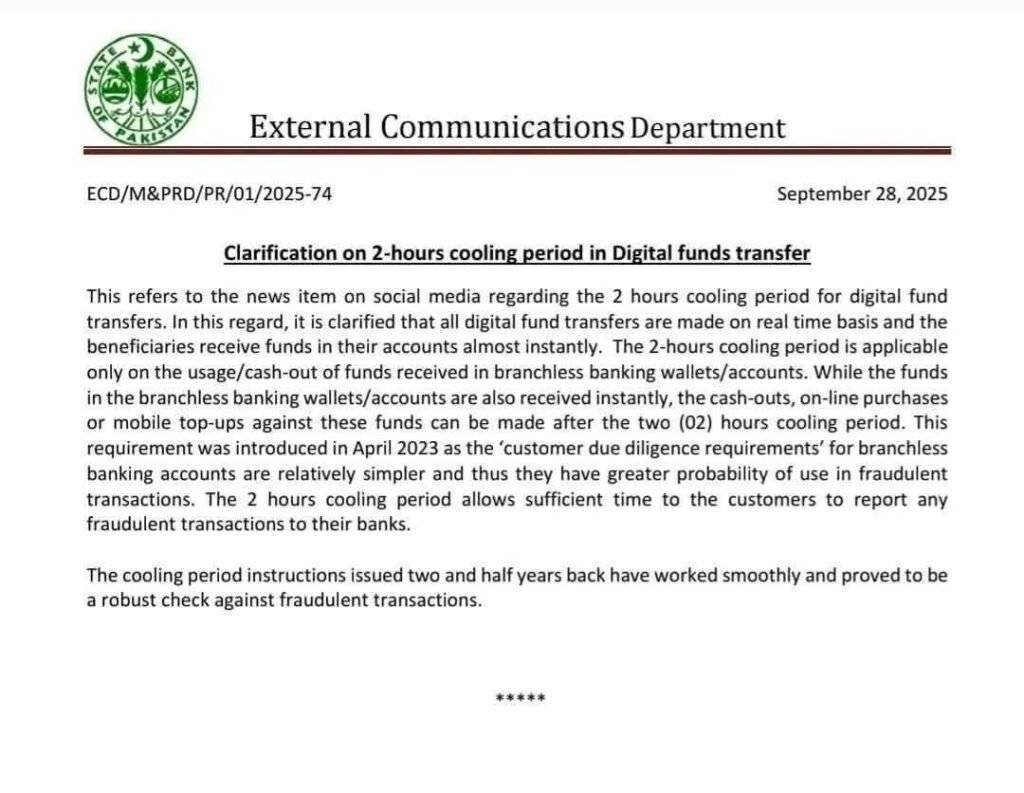

The 2-hours cooling period for digital fund transfers has recently been a subject of discussion on social media platforms, prompting a clarification from the State Bank of Pakistan (SBP). On September 28, 2025, the SBP’s External Communications Department, as per communication ECD/M&PRD/PR/01/2025-74, issued a statement to address public concerns, clarifying the precise application of this regulation.

Contrary to some circulating reports, the SBP affirmed that all standard digital fund transfers between bank accounts remain real-time. Beneficiaries continue to receive funds in their accounts almost instantly, with no delay imposed on these transactions. The instantaneous nature of interbank transfers remains unchanged for standard banking channels.

Where the 2-Hours Cooling Period Applies

The stipulated 2-hours cooling period is specifically applicable to the usage and cash-out of funds received solely in branchless banking wallets and accounts. While funds are indeed credited instantly to these branchless accounts, any subsequent cash withdrawals, online purchases, or mobile top-ups against these funds can only be executed after the two-hour waiting period has elapsed.

This requirement was initially introduced in April 2023. The SBP implemented this measure due to the relatively simpler “customer due diligence requirements” associated with branchless banking accounts. This streamlined process inherently carries a greater probability of being exploited for fraudulent transactions.

“Our objective is to safeguard consumers within the digital financial landscape,” stated an SBP official, speaking to SindhNews.com. “This cooling period provides a critical window, allowing customers sufficient time to identify and report any suspicious or fraudulent transactions to their respective banks before funds can be misused.”

Over the past two and a half years since its inception, the cooling period instructions have proven effective. The SBP notes that the system has “worked smoothly” and emerged as a robust check against a significant number of potential fraudulent activities, enhancing overall financial security in the branchless banking sector. This preventative measure has reportedly reduced reported fraud incidents pertaining to branchless banking by an estimated 15% since its implementation.

Conclusion

The SBP’s clarification underscores its commitment to fostering secure digital financial ecosystems. The 2-hours cooling period, while specific to branchless banking cash-outs and usage, serves as an essential anti-fraud mechanism, ensuring greater protection for consumers against illicit financial activities. This targeted approach effectively balances convenience with robust security, reinforcing trust in digital payment systems across Pakistan.

Summary: The State Bank of Pakistan has clarified that the widely discussed 2-hours cooling period for digital fund transfers applies exclusively to cash-outs and usage from branchless banking wallets, not to instant transfers between traditional bank accounts. Introduced in April 2023, this measure serves as a crucial fraud prevention tool, allowing customers time to report suspicious activity.