Petroleum Prices Set for a Cut

Petroleum prices are anticipated to decrease across the board, providing some relief to consumers. According to informed sources, this reduction is a result of shifts in the international market, which is expected to reflect by this weekend. SindhNews.com reports that these price adjustments will impact various petroleum products, offering some respite to households and businesses alike.

Anticipated Reductions in Fuel Costs

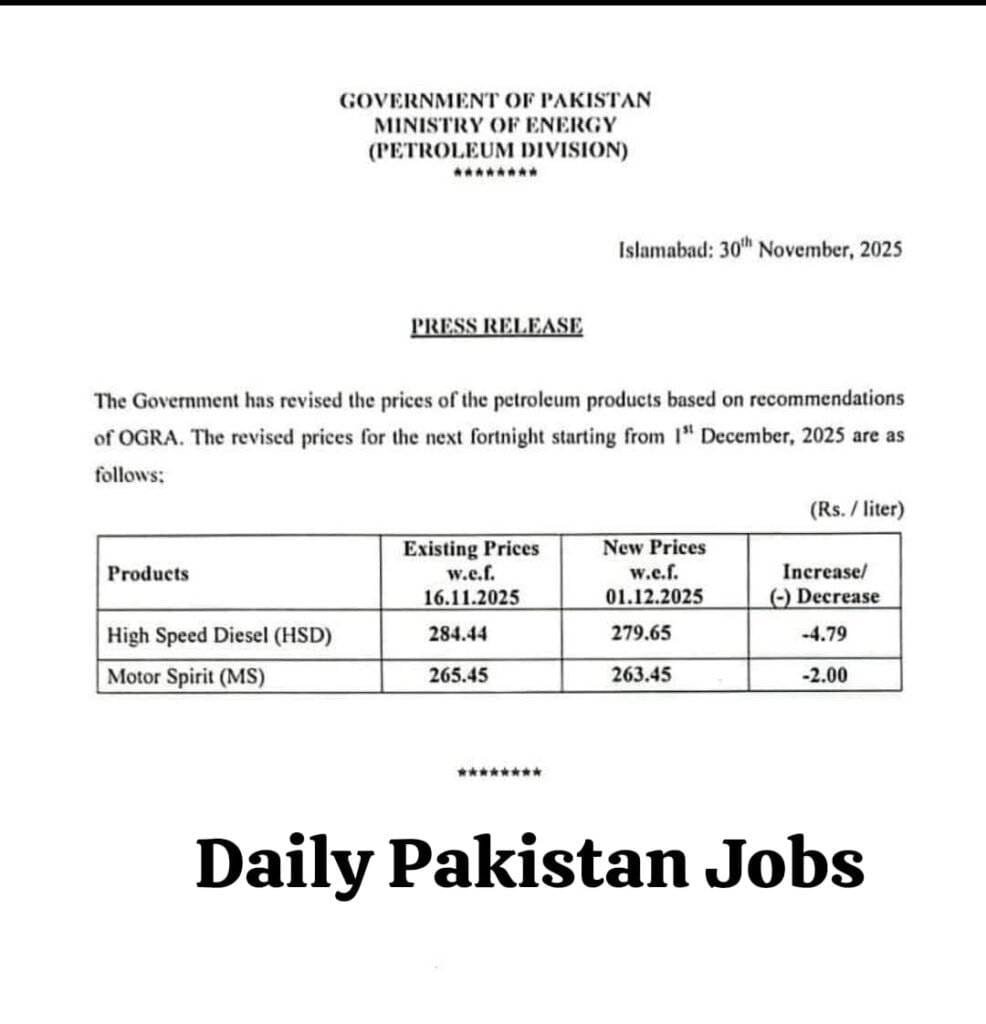

High-speed diesel (HSD) is expected to see a decrease of approximately Rs3.70 per litre, while petrol prices could fall by nearly Rs4.3 per litre. These changes come after significant increases since June 1, 2025 – around Rs12.50 per litre for petrol and Rs29 for HSD. Kerosene and light diesel oil (LDO) are also projected to decrease, by Re1 and Rs6.35 per litre, respectively, according to preliminary estimates from industry insiders.

Impact on Consumers and Transportation

Petrol’s price reduction directly affects the budgets of the middle and lower-middle classes. HSD, used extensively in the transport sector, also influences the cost of goods, as it influences transportation costs for everything from food to consumer goods. The ex-depot petrol price currently stands at approximately Rs265.45 per litre, according to SindhNews.com which may come down to Rs261.75.

Government Revenue and Current Taxes

Despite the expected price cuts, the government continues to levy substantial taxes on petroleum products. The government charges approximately Rs100 per litre on petrol and about Rs96 per litre on diesel. These levies include the petroleum development levy and the climate support levy, as well as customs duties and distribution margins.

In fiscal year 2025, the government earned approximately Rs1.161 trillion through the petroleum levy alone. This figure is projected to rise by 27% to Rs1.470 trillion during this fiscal year, as reported by SindhNews.com.

Conclusion

While the anticipated cut in petroleum prices offers some financial relief, it’s important to keep in mind that the impact is intertwined with existing government taxes. The change underscores the dual reality of fluctuating global markets and the nation’s reliance on revenue from these core products.